Ways to Donate

There are many ways to donate to support the animals. You can make a monetary donation on our website, donate a vehicle, or needed items from our shelter wish list of supplies.

Read about investigations of MCAS donation funds, and our response to ensure donations are spent efficiently for the animals in our care.Donation Policies and Procedures (Updated July 2023)

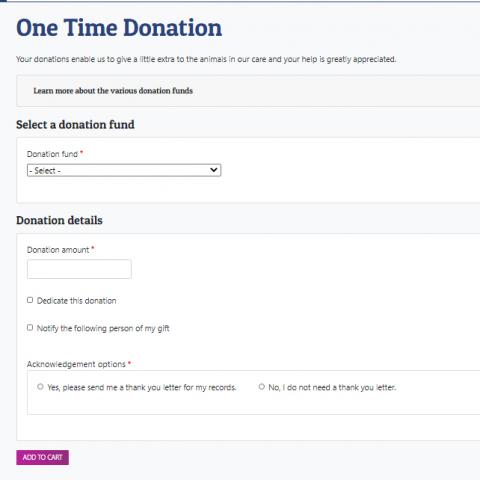

Donate Online

You can donate to your choice of five different donation funds, offering unique support to shelter animals in different ways.

- Adoption & Outreach Fund

- Dolly's Fund Medical Care Fund

- Kitten Triage Program

- Shelter Dreams Fund for a new facility

- Spay & Neuter Community Outreach Fund

Mail a Donation

Donations are welcome and accepted through the mail. Send your check or money order donation along with a description of which funds you would like to support to:

Multnomah County Animal Services

1700 W Historic Columbia River Hwy

Troutdale, OR 97060

Donate Supplies

You can donate vital supplies like treats and toys for enrichment, blankets, and other important items from our donation wish list or order items from our Amazon wish list and have them sent directly to our shelter.

Donate a Vehicle

Multnomah County Animal Services benefits from vehicles donated through the Volunteers of America Vehicle Donation Program. Fill out an online form with details of your vehicle, and a representative from Volunteers of America will contact you to arrange title signing, vehicle towing, and donation receipting. All types and conditions of vehicles, trailers, boats and RVs are accepted.

Donations are Tax Deductible

Charitable gifts made to Multnomah County Animal Services may qualify as deductible charitable contributions under Section 170(c)(1) of the Internal Revenue Code. Multnomah County Animal Services (MCAS) is a division of the Multnomah County Department of Community Services (DCS). Multnomah County is a tax exempt political subdivision of the State of Oregon, organized under Section 170(c)(1) of the Internal Revenue Code.

Tax ID: 93-6002309

Donation Use and Transparency

View donation budget dashboards, and learn about how donations are used and reported.

Budget Dashboards

See reports on Animal Services budgets and expenses from the Multnomah County Budget Office. For running totals and expenditures, see top right corner for information on reported periods and date each dashboard was updated.

- Other Funds Revenue and Expenses Adopted Budget for Fiscal Year 2025 (July 2024 to June 2025)

- View the Running Total Animal Services Budget Expenses for FY 2025

- View Donation Fund Expenditures for Fiscal Year 2025

Donation Funds

All donations to Multnomah County Animal Services are designated to restricted trust funds. Unrestricted donations are split equally between the Forever Home Adoption Outreach Fund, and the Animal Care Trust Fund (Dolly’s Fund). See RESOLUTION NO. 00-126, August 31, 2000.

Donation Policies and Procedures - including definitions and uses for each donation fund

Donation Fund Board Resolution - April 2015

Budget Definitions

Other Funds (Animal Control Fund) - revenue and expenses not included in the Multnomah County General Fund. Other funds include donation accounts and licensing revenue.

The Animal Control Fund includes accounts for revenues from dog and cat licenses and animal control fees per ORS 609.100. Cash transfers are made to the General Fund for animal services programs. The fund also contains donations that are restricted by the donors to be used for programs or projects related to Animal Services.

Budget Monitoring Dashboard Expense Period (01, 02, 03, etc) - These periods on the graph are associated with the month order in the fiscal year (July to June), with 01 being July, 02 being August, and 12 being June.

Ledger Categories

Personnel

Personnel expenses include salaries, benefits, insurance, and other costs associated with full time or temporary employees.

Contractual Services

This category includes Professional Services paid to contracted 3rd parties.

For Animal Services, the top budgeted expenses include:

- Emergency veterinary services provided at Dove Lewis Emergency Animal Hospital

- Community veterinarians providing spay and neuter surgeries post-adoption and other procedures as needed

- After-hours field services and deceased wildlife pickup

- Advertising and outreach expenses to promote adoption, licensing, and awareness campaigns.

Materials and Supplies

Examples of materials and supplies include:

- General supplies for the shelter, animal hospital, or other programs

- Medical and dental supplies

- Costs associated with refunds

- Pharmaceuticals

- Food

- Software and subscription services

- Travel and training

Internal Services

Internal Services refers to overhead expenses for Animal Services operations using other county resources, including:

- Data processing and maintenance of computing systems

- Facilities property management expenses

- Facilities service requests for repairs and maintenance

- Fleet services for MCAS officer vehicles and transport vehicles

- Communications equipment and services

- Distribution of equipment and supplies

- Service records

- Enhanced building services

Cash Transfers

Cash transfers are not expenses, but internal transfers to balance fund accounts. Revenue from licenses and adoption fees are transferred from the Animal Control Fund back into the County General Fund.